Real Estate Tax Vermont . loading data… 2025 vermont common level of appraisal map. Contact your town to find out the tax. your vermont property tax bill. Some of your clients may. Local property tax rates are determined by. Learn how to file and pay property transfer tax, read. the median property tax in vermont is $3,444.00 per year for a home worth the median value of $216,300.00. Local property taxes and the state education tax rate. vermont offers a property tax credit which assists some homeowners with paying their property taxes. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. there are two types of property taxes in vermont: Here is what you need to know.

from www.templateroller.com

the median property tax in vermont is $3,444.00 per year for a home worth the median value of $216,300.00. there are two types of property taxes in vermont: Local property taxes and the state education tax rate. vermont offers a property tax credit which assists some homeowners with paying their property taxes. Local property tax rates are determined by. Here is what you need to know. Some of your clients may. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. your vermont property tax bill.

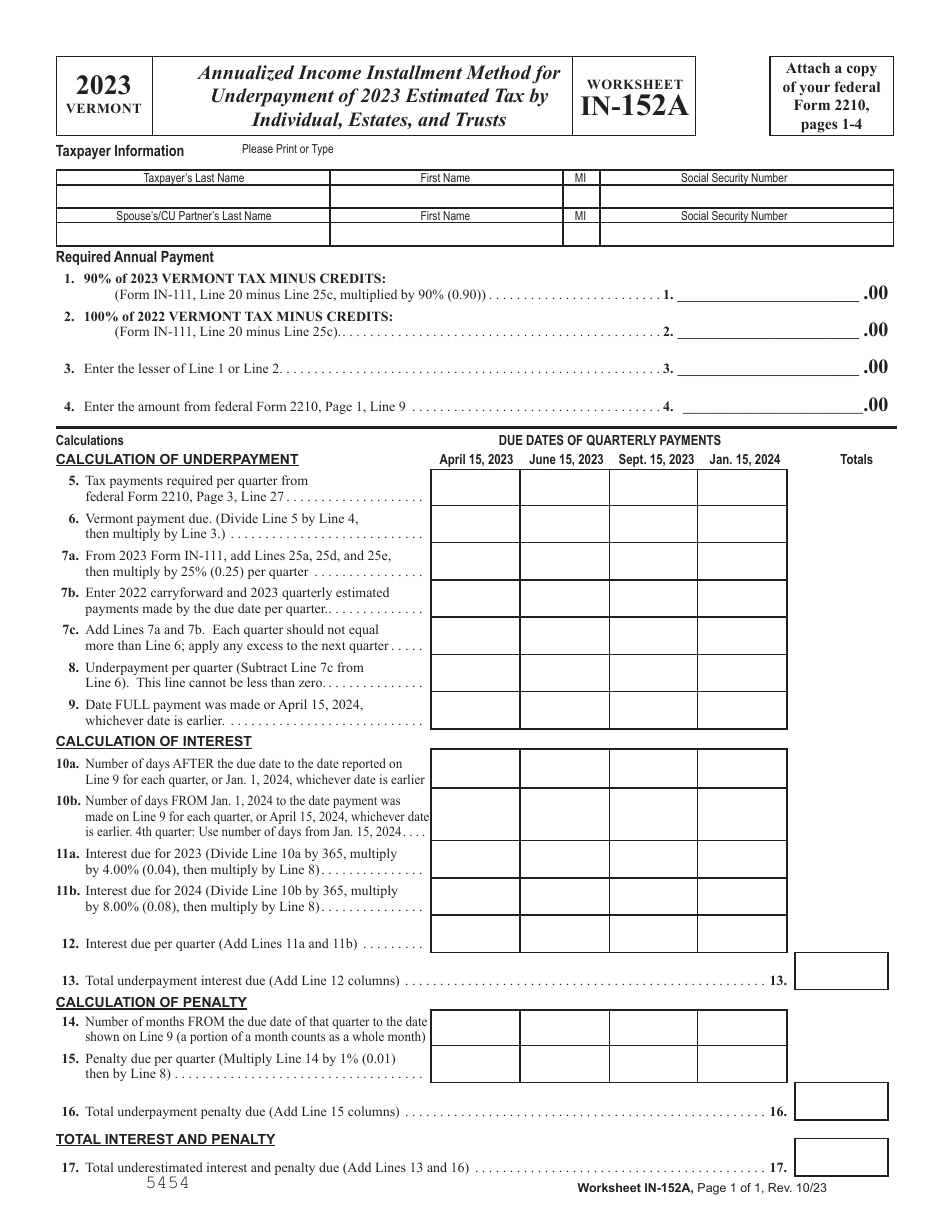

2023 Vermont Annualized Installment Method for Underpayment of

Real Estate Tax Vermont your vermont property tax bill. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. your vermont property tax bill. Here is what you need to know. loading data… 2025 vermont common level of appraisal map. vermont offers a property tax credit which assists some homeowners with paying their property taxes. Local property tax rates are determined by. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. Contact your town to find out the tax. the median property tax in vermont is $3,444.00 per year for a home worth the median value of $216,300.00. Learn how to file and pay property transfer tax, read. Local property taxes and the state education tax rate. there are two types of property taxes in vermont: Some of your clients may.

From www.templateroller.com

VT Form E2A Download Fillable PDF or Fill Online Estate Tax Information Real Estate Tax Vermont Here is what you need to know. Some of your clients may. vermont offers a property tax credit which assists some homeowners with paying their property taxes. your vermont property tax bill. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Local property tax rates are determined by. loading. Real Estate Tax Vermont.

From www.templateroller.com

VT Form RW171 Fill Out, Sign Online and Download Fillable PDF Real Estate Tax Vermont Local property taxes and the state education tax rate. Here is what you need to know. Some of your clients may. the median property tax in vermont is $3,444.00 per year for a home worth the median value of $216,300.00. there are two types of property taxes in vermont: Tax bills are generally mailed to property owners 30. Real Estate Tax Vermont.

From vtdigger.org

With property values soaring, Vermont towns need reappraisals. But Real Estate Tax Vermont vermont offers a property tax credit which assists some homeowners with paying their property taxes. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. loading data… 2025 vermont common level of appraisal map. the median property tax in vermont is $3,444.00 per year for a home worth the median. Real Estate Tax Vermont.

From www.taxuni.com

Vermont Estate Tax 2023 2024 Real Estate Tax Vermont loading data… 2025 vermont common level of appraisal map. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. your vermont property tax bill. Learn how to file and pay property transfer tax, read. Here is what you need to know. Some of your clients may.. Real Estate Tax Vermont.

From nancyjenkins.com

Vermont Property Tax Rates Nancy Jenkins Real Estate Real Estate Tax Vermont your vermont property tax bill. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. Learn how to file and pay property transfer tax, read. Contact your town to find out the tax. there are two types of property taxes in vermont: Local property taxes and. Real Estate Tax Vermont.

From www.peetlaw.com

Vermont Property Transfer Tax Real Estate Tax Vermont there are two types of property taxes in vermont: Local property taxes and the state education tax rate. Some of your clients may. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Learn how to file and pay property transfer tax, read. of the 257 towns and villages with tax. Real Estate Tax Vermont.

From www.templateroller.com

VT Form EST191 Fill Out, Sign Online and Download Fillable PDF Real Estate Tax Vermont Contact your town to find out the tax. Some of your clients may. vermont offers a property tax credit which assists some homeowners with paying their property taxes. Local property tax rates are determined by. Here is what you need to know. Learn how to file and pay property transfer tax, read. the median property tax in vermont. Real Estate Tax Vermont.

From esign.com

Free Vermont Residential Purchase and Sale Agreement PDF Word Real Estate Tax Vermont there are two types of property taxes in vermont: Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Contact your town to find out the tax. your vermont property tax bill. Local property taxes and the state education tax rate. the median property tax in vermont is $3,444.00 per. Real Estate Tax Vermont.

From www.formsbank.com

Vermont Estate Tax Form printable pdf download Real Estate Tax Vermont of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. loading data… 2025 vermont common level of appraisal map. Local property taxes and the state education tax rate. your vermont property tax bill. Local property tax rates are determined by. Tax bills are generally mailed to. Real Estate Tax Vermont.

From www.templateroller.com

VT Form HS122 2019 Fill Out, Sign Online and Download Fillable PDF Real Estate Tax Vermont your vermont property tax bill. Here is what you need to know. Local property tax rates are determined by. Learn how to file and pay property transfer tax, read. Contact your town to find out the tax. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal.. Real Estate Tax Vermont.

From www.signnow.com

Real Estate Transactions in Vermont Vermont Bar Association Form Fill Real Estate Tax Vermont loading data… 2025 vermont common level of appraisal map. vermont offers a property tax credit which assists some homeowners with paying their property taxes. your vermont property tax bill. there are two types of property taxes in vermont: Learn how to file and pay property transfer tax, read. Tax bills are generally mailed to property owners. Real Estate Tax Vermont.

From www.templateroller.com

Form BI476 Download Printable PDF or Fill Online Vermont Business Real Estate Tax Vermont Contact your town to find out the tax. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. your vermont property tax bill. Some of your clients may. loading data… 2025 vermont common level of appraisal map. there are two types of property taxes in vermont: vermont offers a. Real Estate Tax Vermont.

From www.peetlaw.com

Understanding Property Tax Prorations at Vermont Real Estate Closings Real Estate Tax Vermont the median property tax in vermont is $3,444.00 per year for a home worth the median value of $216,300.00. vermont offers a property tax credit which assists some homeowners with paying their property taxes. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Here is what you need to know.. Real Estate Tax Vermont.

From listwithclever.com

Vermont Real Estate Transfer Taxes An InDepth Guide Real Estate Tax Vermont Tax bills are generally mailed to property owners 30 days prior to the property tax due date. your vermont property tax bill. vermont offers a property tax credit which assists some homeowners with paying their property taxes. Some of your clients may. Contact your town to find out the tax. loading data… 2025 vermont common level of. Real Estate Tax Vermont.

From www.templateroller.com

VT Form TPP651 Download Printable PDF or Fill Online Telephone Real Estate Tax Vermont Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Contact your town to find out the tax. your vermont property tax bill. Local property taxes and the state education tax rate. loading data… 2025 vermont common level of appraisal map. of the 257 towns and villages with tax data. Real Estate Tax Vermont.

From www.peetlaw.com

Vermont NonResident Withholding Tax Real Estate Tax Vermont Here is what you need to know. Local property tax rates are determined by. loading data… 2025 vermont common level of appraisal map. Some of your clients may. Learn how to file and pay property transfer tax, read. there are two types of property taxes in vermont: Local property taxes and the state education tax rate. of. Real Estate Tax Vermont.

From www.templateroller.com

2021 Vermont Annualized Installment Method for Underpayment of Real Estate Tax Vermont of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. Learn how to file and pay property transfer tax, read. Local property taxes and the state education tax rate. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. loading. Real Estate Tax Vermont.

From www.templateroller.com

2018 Vermont Worksheet in152a Annualized Installment Method Real Estate Tax Vermont vermont offers a property tax credit which assists some homeowners with paying their property taxes. Local property taxes and the state education tax rate. your vermont property tax bill. the median property tax in vermont is $3,444.00 per year for a home worth the median value of $216,300.00. Contact your town to find out the tax. . Real Estate Tax Vermont.